Capital Outlook

The booming Bay Area economy of the recent past and the support of the Mayor, Board of Supervisors, and citizens of San Francisco gave rise to historic levels of capital investment in the years leading up to 2020. As a result, even in the face of the current economic crisis, San Francisco is well positioned to build a healthy and well-balanced infrastructure program for future generations.

As the City responds to COVID-19 and moves towards recovery, there are new challenges ahead. Funds that might have been directed to one-time investments may be needed to shore up ongoing programs to avoid reductions in social services and employment. At the same time, the age of the City’s infrastructure and projected population growth in formerly industrial areas represent ongoing demands that will become more pressing the longer they go unaddressed.

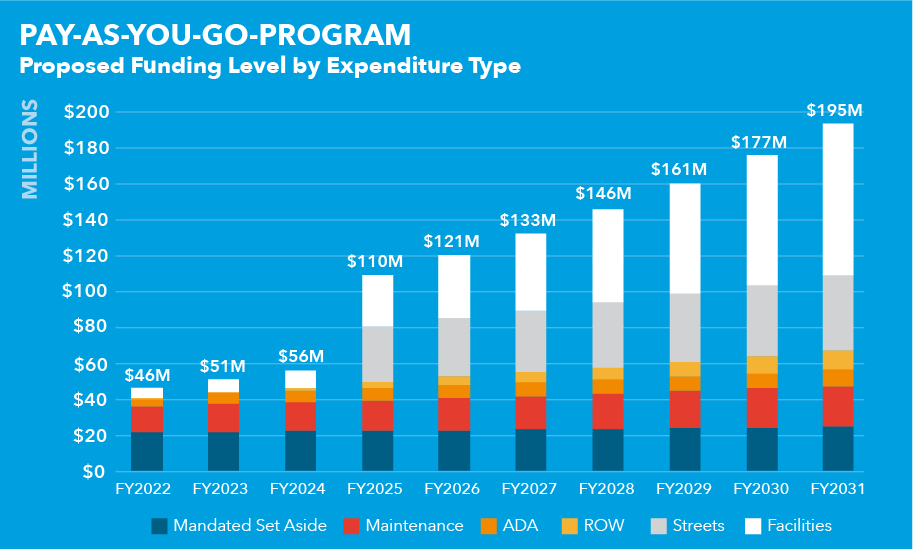

The Plan recommends a level of funding of over $38 billion over 10 years. Despite this, the Plan defers nearly $7 billion in identified needs for General Fund departments, assuming recommended Pay-As-You-Go program funding levels as shown in Chart 2.1.

Chart 2.1

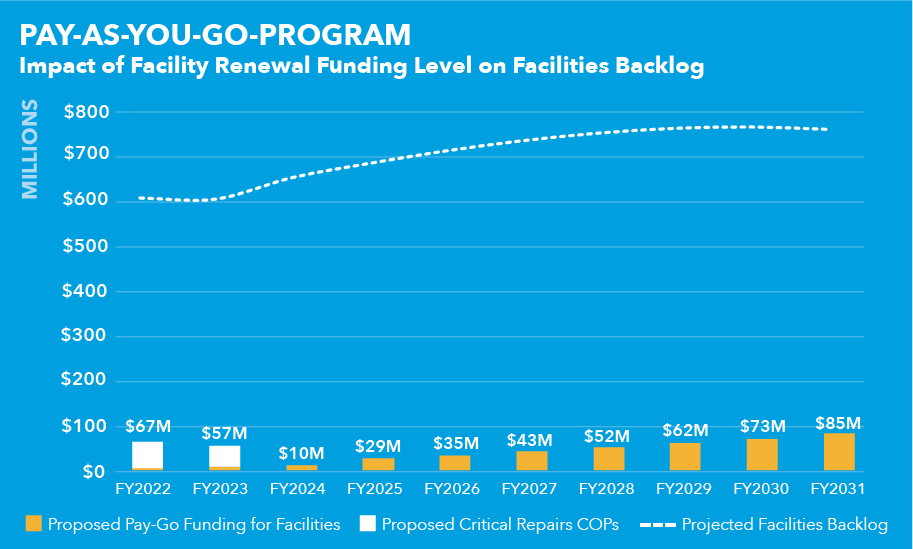

Years of historic underinvestment in the City’s capital program has resulted in a current facilities backlog of $621 million for General Fund facilities. The backlog is defined as the difference between the total current renewal need and the portion of this need that is funded in the first year of the Plan. The total current renewal need includes both items identified by departments as deferred maintenance, as well as first-year renewal needs. This backlog does not include buildings and sites for Recreation and Parks. While the department has identified a 10-year renewal need of $1.2 billion, funding towards those needs will come from the Recreation and Parks set-aside within the Pay-Go program, as well as the planned 2028 Neighborhood Parks and Open Space G.O. Bond, pending voter approval.

Under this Plan, if the City meets the Plan’s funding recommendations, the existing facilities backlog is projected to start trending downward by FY2031. As compared to the current level, the backlog is still projected to increase 20% to over $750 million, as shown in Chart 2.2. This expected increase is the result of needs accumulated during low spending periods and projected cost escalation of today’s backlog. To address the gap, the City continues to investigate various approaches, including revising funding benchmarks, leveraging the value of City-owned assets for debt financing, preparing projects for voter consideration at the ballot, forming public-private partnerships, and exploring new revenue sources.

Chart 2.2

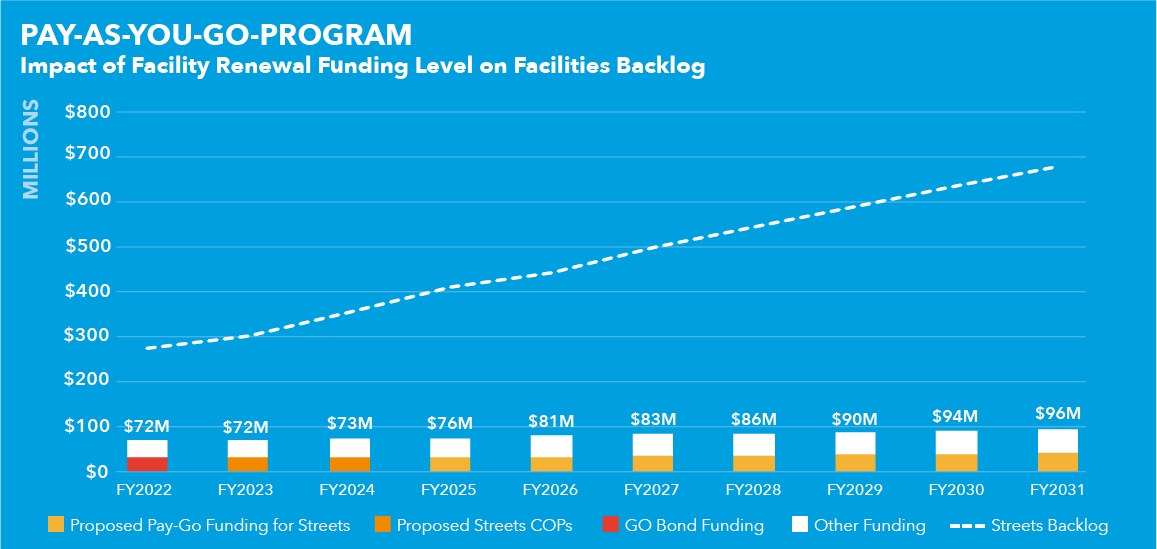

While the City has made significant progress in improving the quality of its streets in recent years, having already attained a “good” Pavement Condition Index (PCI) of 75, a streets backlog of $280 million remains if the City is to reach a PCI of 83, at which point the year-on-year cost of maintaining the streets declines significantly. Under this Plan, given the funding challenges to the Pay-Go Program due to COVID-19, the streets program has been supplemented with additional funding from the recently-approved Health and Recovery G.O. Bond and FY2023 and FY2024 Certificates of Participation. Despite these efforts in the short-term, the PCI is projected to decline to 74 and the existing backlog is projected to increase to over $688 million by FY2031, as shown in Chart 2.3.

Chart 2.3

In addition to the formidable backlog, there are a number of other issues that the City will face with regard to our capital program, and the associated risks will have to be managed.

Though the pandemic certainly slowed construction activity in the short term, there is still strong local demand for construction services, keeping overall construction costs in San Francisco high. While this activity buoys the local economy, the cost of construction strains available resources. Displacement and recovery efforts from natural disasters across northern California continue to exacerbate the already tight construction labor market. COVID-19 safety precautions bring with them extra costs and in some cases slower delivery schedules. The City is well-positioned to be a counter-cyclical investor, but with persistently high local costs, there are still limits to what those investments can be expected to deliver.

Finally, striving to achieve resilience in San Francisco presents its own challenges. As a densely populated, aging city situated between two fault lines and surrounded by water on three sides, the threats of disaster and climate change raise serious safety concerns. At the same time, racial inequality and economic hardship threaten the fabric of San Francisco’s communities, and housing affordability remains out of reach for many. The City must balance our efforts on these fronts and keep them all moving forward.

However difficult, crisis brings opportunity. Through the Economic Recovery Task Force, the Climate Action Plan, ConnectSF, and many other recent and citywide planning efforts, San Francisco has laid out intentions to build a strong, equitable, and resilient future. In particular, San Francisco’s commitment to climate resilience and the need to respond to current hazards like heat, air quality events, and sea level rise will drive the exploration of new strategies to deliver improvements. Likewise, the pandemic will push the City to seek out options for partnership and to prioritize stimulus projects that can bolster the local economy. As part of that recovery, the City will be able to make investments to improve public health, safety, and quality of life.

This Plan puts forth a robust plan that balances maintaining current assets in a state of good repair with investments in major projects to build out of the current crisis. Though there are risks associated with the pandemic, construction costs, a substantial capital backlog, and the scale of need, the City’s capital program is well positioned to respond and deliver a strong program of investment for San Francisco’s recovery.